For new or smaller businesses, this entire article is going to fly straight over your head, however for larger businesses and for me personally, its a question that has been bothering me for quite some time now. Months apparently.

That question is:

Why do sales through a specific sales channel, tend to stay consistent?

In this article I address this question and it wasn’t until I asked for help, that the real answers came through. It’s also raised further questions, such as how do you deal with this, what options do you have and how can you tackle this with your business model. I actually feel I am now left with more taxing questions than I originally started with.

This really is the upper extremity that I am considering here, if your business is new or is not optimised using any of the 3 rules I cover in a moment, then you should not even concern yourself with this article at all. However, if you’re hitting “limits” on different sales channels, then you really need to read this.

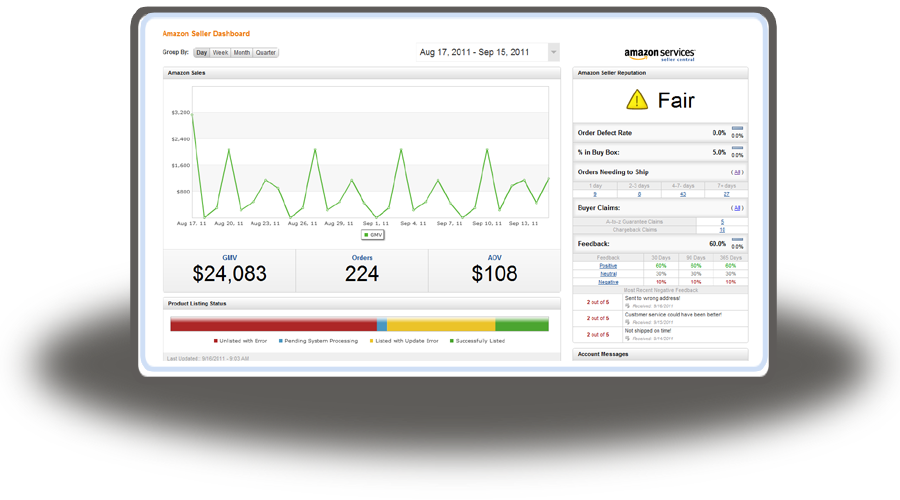

For a number of years now, I’ve seen merchants selling on multiple platforms hitting a limit of what can be done with a marketplace. For example, businesses that are in a specific niche, their sales will rarely go above or below a 20% window on a daily basis.

There may be “spikes” in sales on a daily basis and seasonality does have a positive effect on most businesses. But overall, most businesses stay consistent.

To understand why I’d be asking myself this question in the first place, I have been working on a set of 3 rules as the basis of expansion/profitability, they also spell “ESI” or are pronounced as “easy!”, which is the ultimate goal of where I am going with these and there is a fourth part that I discuss later in this article. Anyway, the for now these three rules are:

- Efficiency

Both internal & external. Internal is everything your customer does not see, like tools, processes etc… and external is everything your customer does see, branding, the application of persona’s etc..

- Sales Channels

By adding more of them or refocusing on a specific channel to “catch up” with others or to break into a new or refocus upon a competitive advantage.

- Inventory

Either wider or deeper inventory. Range selling, new product verticals (widening the current range) or deeper inventory (thus better price points & supplier relationships)

However, it’s common for a merchant to hit a “limit” on a specific marketplace like eBay or Amazon and I was not happy that “operational efficiencies” were the cause. I know first-hand after spending a few months helping one specific company on-the-ground overcome these and was not happy with the standard reply to such a question. There had to be another reason.

Another aspect has concerned me greatly; what if a client I am working with is actually at 95% efficiency of a channel, what really are the options and what can I do to help them overcome this inherent boundary?

There was only one person that I knew that could possibly hold the answer or even comprehend what I was referring to in the question. This person was perfect for a number of reasons, the first that he has been in this arena longer than I have, seen more merchants than myself on the differing marketplaces and critically seen the sales data to back this up. That person was Marshall Smith from ChannelAdvisor.

Here is the first email, that I sent over to Marshall. Noting that I have been bothered by this for months. In a conversation on Monday of this week, it was pointed out I had been asking the participant the same question in January.

Hi Marshall,

Here is a question, that I think only you can answer.

Its a question that has been bothering me for quite some time, “Why do eBay sellers sales stay consistent?”

To be more precise, I have noticed that specific sellers sales, never move out of say a 20% window, for example seller X has a average sales of £10,000, the daily fluctuations mean that their sales will never (or rarely do) move outside of 2K below and 2K above.

Surely there are too many factors for a business to consistently land in the same “window” of sales every single day. I understand why this maybe engineered to happen, but that raises more questions that it answers as the most obvious one is “how to you break or work this limitation?”

Have you seen this also?

The first reply is below, it clearly shows that Marshall understands the common issues that occur and why I was right to ask him in the first place.

Matthew –

When I see that situation it’s the same as a regular retail business that’s hit a certain volume and ceiling in their current business practices, so that growth is just not an option for them as they’re trying to run things. They might have a software solution that’s put a ceiling on how much they can get done because it’s not as efficient as they need and a lot of time is spent managing the technology.

They might be short on people (or have chosen to stay at a certain size) and they’re doing all they can every day so there’s no room to grow. Even more common is that people get comfortable and aren’t looking for a change – look at all of the people that have complained about eBay’s changes in the last few years rather than embracing them and recognizing that being ahead of the curve means they’ll pick up the business their competitors lose. There have been plenty that are willing to do that, but even more that had gotten comfortable and just want to keep doing what they’ve always been doing.

One of the things that I’ve found hardest over the years when trying to explain the value that we provide to users is getting them to value their own time. Many times there’s a sole proprietorship that’s been running things using something like Turbo Lister and spending hours and hours every day just to manage their sales. They see it as “free” but aren’t accounting for how much time it costs them to manage that information. Even if they just stay on eBay, coming over to us is going to save them time that they can use to grow their business or go do some other leisure activity instead.

If we just cut the amount of work they’re doing from 6 hours to 3 hours every day (and we’re usually a lot better than that) then we’ve saved them 60-90 hours every month. For that fee that we charge, broken out on a per-hour basis, they’d be hard pressed to get someone that could handle that amount of information and that level of capability to guarantee their business keeps running the same as it’s always been for that amount.

They free up their time to expand their business or focus on customer service, areas that usually didn’t get handled nearly as well before. Yet, they see it as a “cost” because they weren’t calculating the value of their time that they were spending inefficiently to run the business before.

So many of those people have gotten trapped in a pattern where they have something that’s working that they don’t want to change because they fear change or don’t think they have any cash to invest into the business. Most of the time those types of sellers never even get to the level that we’re going to be dealing with them as they fall out of the sales cycle for one reason or another.

If they’re a serious business and want to grow then there are things we can do for them, but if they haven’t figured out the business cycle and a mid to long range plan to grow then we’re going to be big and scary to them.

We’ve had people tell us we made changes to their business that took 8-10 hours of daily work down to just 1 hour a day. Then they finally had the opportunity to grow their business, source more product, expand product lines, hire more employees, and finally get growth back into their business.

Marshall

Note: I understand that the above is quite a lot for most of you to take in, what this question did in short was highlight that Marshall was the right person to ask. We both [Marshal & I] had reservations that some of you may just not “get this” at all. If this is the case, then the rest of this article is probably a waste of your time.

Ignoring that Marshall has created a dozen articles worth in that reply alone, lost about 90% of the people that may read this [Stay! This really does hit gold shortly], it clearly showed that he was the right person to ask.

However I needed to redefine it, we had missed the goal I was looking for. And trust me, we hit it the jackpot in his reply to the following:

Howdy Marshall,

Ah it shows that you understand!

Now remove the users and the software as variables or imagine they’re 90% efficiency.

Why do their sales stay within a 20% window all the time? No major fluctuations, yea some days less, some days more, but never outside of their “boundary”.

Take Amazon sellers, they get the buy box, the sales flood in, its price dependant for sales volume (ignoring lots of other stuff), eBay its different, there is some form of cap or barrier in place??

Now this is where we hit the jackpot and I strongly suggest you read this at least twice as it’s that important:

There’s no buy box in the eBay experience, so you’re subject to the whims of what people are buying at any given point. At a very macro economic level, the demand for most items is pretty consistent and follows a standard pattern.

People replace their shoes on a certain cycle. At a macro version of the economy, there are always X% of people that are shopping for shoes. That keeps the demand at a pretty consistent stream. Then when there’s not something adjusting the demand direction like the Buy Box, then the sellers are exposed at about the same rate that they always are, causing the sales to be within a reasonable statistical level of average.

To parallel to another environment, think of the casino – any individual user might win or lose on the smaller scale, but at the big picture of all of the people playing all of the games the house knows what their rate is going to be and how much they’re going to make as a percentage of the overall bets. That house advantage is the macro version you’re seeing among these sellers where the growth pattern is to:

* improve their placement in the exposure to capture a larger proportion of the regular buyers (Buy Box)

* expand their product line to make the universe of potential buyers for them to be a larger group

* expand the distribution channels to open up the existing product to a larger overall audience

Since you can’t (really) get the Buy Box on eBay (eTRS and Best Match only goes so far) then really the only way to grow is to expand the product line or do additional stuff off-eBay.

A lot of people get comfortable with their products and what they know of eBay, so they don’t change any of these things and grow up to the point that they’ve captured “their share” and then are stagnant from that point forward.

That was okay in the past when eBay was growing at such a clip that people were seeing 20-30% annual increases because they were just riding on the coattails of eBay growth, but when that slowed down they weren’t ready and just got frustrated and confused.

When they pay attention to the types of things we both talk about, that’s when they’re able to address one or more of these points and expand their business again instead of being stuck on a plateau.

Marshall

What Marshall had highlighted were the following:

- There is a pretty much consistent demand for some product ranges, like shoes.

- With all factors being equal, sellers are exposed to buyers at a consistent rate

- There is only so-much you can do in a single marketplace

- There is only so-much you can do with a specific product range

- If you just tread-water, then you’re not going to see the high increases that you used to see, as eBay’s growth rate has slowed down

You cannot imagine the gravity of these 5 points were to me. I had been pondering over this for several months and in this one reply, which was comparable to being hit in the face with a kipper. It all became clear. It’s also raised bucket loads of other questions, but it was finally answered.

In short, as Marshall puts it so aptly, “You can no longer ride the coattails of eBay for growth”. This also extends to every other marketplace there is as well. There is an inherent cap to the number of people looking for a specific product on a specific day on a specific marketplace.

Yes, globally this number may be a huge, however on a macro level each and every marketplace, the number of customers you can reach and convert is limited.

The E, the S, the I and the?

In the 3 rules of ESI, I give equal value to each of rules, that is, that efficiency carries a weighting of one, the same as sales channels and inventory. However within each of these, the weighting is not equal and it’s the combination of them that equate to something higher than just 3.

However, if just one is exceptionally poorer than the rest, then that heavily out weighs the others. In simple terms (I like to use metaphors, get used to them, there are more) its like a Ferrari with elephant as a passenger and coal as the fuel, you got some of the right gear, but you ain’t going anywhere.

If you’ve got a great listing template and no inventory, if you’ve got a world class backend system, but no sales channels, if you’ve got masses of inventory and a limited backend tool and only a single marketplace. You’re not going to get very far and there is no way you’ll ever hit the boundaries that we’ve been discussing in this article.

This is why its absolutely critical to your business that you pick the right tools for the job, because without them you’re not going very far and with them all in harmony, you’ll outpace “The Stig“.

I hinted earlier that I am working on a fourth part to the ESI structure, this is one is special, because this one is a multiplier. While the others cumulatively have a positive effect, this one is ultra special because with this one executed currently multiplies the gains of the first three.

The multiplier is “Why”. Why are you doing what you are doing and what guides you to what you are doing. A business with no drive is pretty much only ever going to tread water, however, if you lob in the magic of a say a CEO like Steve Jobs that will ensure that a company will succeed huge personal cost, then this is a multiplier.

My equation (again I am trying to keep this as a simple as possible) looks like this:

Results = (Efficiency + Sales Channels + Inventory) x The “Why” Factor

As you can see, even if the sum of the E, S & I are low, if you say have someone or a purpose to add in a “Why Factor” then all these are multiplied and that is why I believe that most small businesses that stick longer than a year, have this very special ingredient.

Determination and grit are absolutely required and its these kind of factors that multiply the results. I am reminded over a conversation in a meeting a few months back, where it was blatantly obvious that my role in the conversation was to highlight that what they lacked for, did not matter. What did, was that they had the determination to make it happen, “The Why Factor” and I think you might have already guessed it, they are winning.

A stark summary of this entire article, is that there is a limit to what you can do on a single marketplace.

The inherent cap, does not impact all business models, if you’re business is subject to multiple customer bases (eg. B2C & B2B) and/or irregular stock levels, then this cap is going to yo-yo and give inconsistent sales on a frequent basis, by its very nature. However if your business is homed-in on a specific niche then if you’re not at this wall yet, then you will be soon (or later).

I’d like to extend a public thank you you Marshall from ChannelAdvisor. It was not my intention to use his replies in this article, but as I started working on it over the course of over a week or so, it became apparent that without his replies, the story of arriving at the final answer, would fall far short without its inclusion. Thank you.

Image Source

What will you change today?

What will you change today?